About IBL Loans

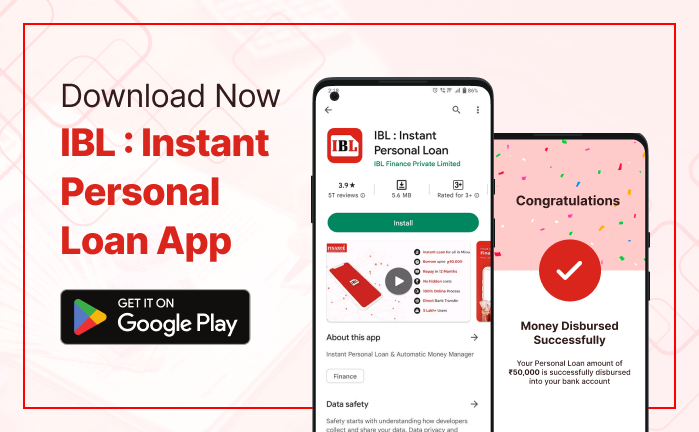

IBL Finance is a new-age fintech based financial services platform that leverages technology and data-science to make lending quick and easy.

IBL Loans offer paperless and contact less digital personal loan upto Rs 50,000, Avail credit whenever you want.

No, there are absolutely no charges to apply for a loan.

Eligibility

To successfully apply for credit, you must be an Indian citizen and 21-50 years of age.

Only Valid number of PAN card and Aadhar card along with bank details required at the time of application.

You have a good credit score in order to be eligible for credit from IBL Loans.

Please visit our IBL Loans mobile application to get updated list of operational area.

What is the elegibility criteria to apply for credit with IBL Loans?

Product

The minimum tenure that you can get on IBL Loans is 3 Months and the maximum is 6 months.

The minimum tenure that you can get on IBL Loans is 3 Months and the maximum is 12 months.

The minimum amount that you can borrow on IBL Loans is Rs.2,000. The maximum loan amount is dynamically calculated by our algorithm and can go up to Rs.50,000.

Yes, you can apply for a new loan after completion of existing one.

Application Process

Mandate (Auto Debit)

Mandate is an auto-debit instruction from you that authorises us to collect your EMI payments directly from your bank account. We will only collect the payment due and no more.

Yes, NACH form is mandatory for auto dabit.

Repayment

There are two modes of payment. You can either pay with the auto-debit instruction which was set up during the time of loan application or you can pay using the the app via netbanking / card. For the auto-debit, kindly ensure that you have sufficient funds in your account on EMI due date.

Not possible, auto-debit is mandatory for the loan application to be complete.

There will be a NACH return charge levied on your loan account. Also, you will incur a late payment fees for the delay in payment.

There are no additional fees beyond processing fee, if your payments are made on time. In case you are late, a late payment fee will apply.

As of now, once the EMI date is finalised, it cannot be changed.

Your performance will contribute to your CIBIL score. Regular timely payments will help you build your CIBIL score. You won't however get extra points for paying your balance sooner than its due date.

Yes, you may prepay the loan with prepay charges on the outstanding loan amount.

Unfortunately, changing the tenure will not be possible once the loan is disbursed.

Unfortunately, it is not possible to change the due date of an EMI payments.

Interest Rates and Fees

Your interest rate will be a function based on your credit score.

There will a processing fees on your loan. This is to cover the costs of on-boarding including multiple document verifications, bankers verification, payment setup and processing.

We charge EMI return charges and late payment penalty on any delayed loan repayment. The late payment penalty amount depends on loan amount and extent of delays.

Security and Privacy

In case of rejection, your submitted data will be stored securely with us in case you may want to reapply again in future. Under no circumstance, will your data be sold/shared with third parties without your consent except as required by law. If you would like, you can delete your account from the app in which case all except the mandatorily requied data by RBI will be deleted. You'll need to provide all the required documents again if you wish to reapply in future.

Our systems are designed to protect your data. The data sent by you through the website and app is protected with industry standard encryption. We follow the same security standards that are followed by banks. Your data stored on our servers can only be accessed through your credentials or internally by IBL Loans personnel when they are helping you out with your applications. We have procedural safeguards in place to ensure the security of your data while it is being handled by the staff at IBL Loans.

Support and General Queries

This is a score from the Credit Information company. It is a record of a borrower's credit worthiness based on their past record of their loan repayments among other things. A credit score ranges from 300 to 900; banks usually require a score of 706 or above to qualify for credit.

No, the credit limit is set automatically based on your credit score and other relevant information.

Currently, we support android platform. We may launch our iOS and Windows apps in future.

You can re-apply after 1 months of your loan rejection. (If application rejected due to credit report then re-apply loan after 3 month)