What is IBL Finance?

IBL Finance is a new-age with fintech based financial services platform that leverages technology and data-science to make lending quick and easy.

We use technology and data-science to make lending quick, simple and hassle-free. We believe traditional ways of lending can exclude those most in need because of outdated, rigid and often inefficient processes. At IBL Finance, we have simplified the lending process with a sharp focus on serving our borrowers’ unique needs and circumstances – offering our customers a truly superior borrowing experience.

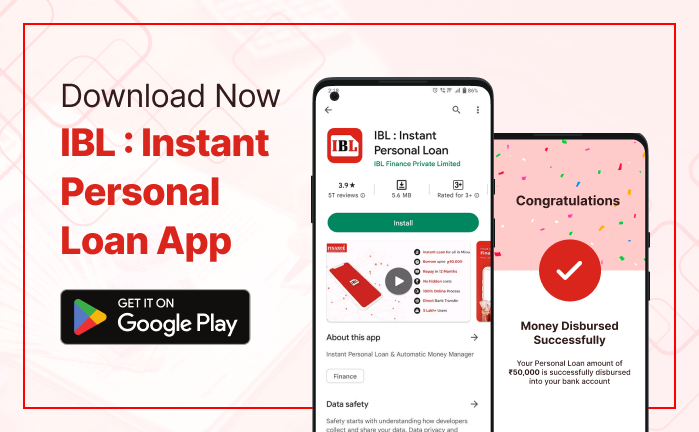

IBL Finance is a leading mobile App that provides instant personal loans through a 100% digital process. You can get a personal loan up to a limit of ₹50,000 in a span of time as low as 3 minutes. It has revolutionized the tedious traditional lending process which needed physical availability for a loan, a lot of paperwork and getting an amount specific to a need only. You can download the IBL Finance app and apply through a simple guided process and get the required amount disburse within minutes.

We have been successful in building advanced data science-driven underwriting algorithms that help us aggregate data from different mediums and generate a credit report with over 500 data points available. Thus, with us, you don’t have to worry about the complex loan process and long turnaround times. We fill up in your pocket in the form of an app that allows you to apply and get a loan instantly.

We provide financial freedom in a

much smoother and efficient manner.

We Offer

An instant loan to provide you with the perfect financial boost in the most convenient and hassle-free manner

We make sure that your request is approved and the money is transferred in almost no time.

Our Vision

economy, we provide financial freedom in a much smoother and efficient manner.

Quick personal loans have been made available through the following three features : Easy Online Application, Quick Processing Time, Immediate Transfer of Funds.